In continuation with the previous article about NIFTY Volatility based on time of day, here is another simple way of understanding the market structure of NIFTY.

Previous article - https://www.niftyscalper.com/blogs/2017/8/8/article-excerpt-niftyscalper-data-analysis-fundamentals-of-short-term-trading-part-two-dr-brett-n-steenbarger

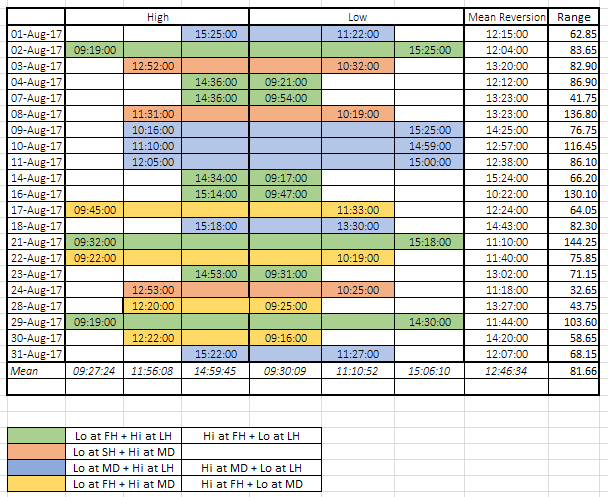

You can create a simple excel sheet to capture the following details, Time stamp for - High, Low, and Mean Reversion of the day. I have categorized time as 1st hour (FH)/last hour (LH) and Mid Day (MD). You will see a pattern here, and over time you may be able to internalize this pattern.

As an Intraday trader I am direction agnostic here, and as you can see there are only 4 types of days. And yes for the best part, look at the Mean Reversion column, it speaks for itself.

Combining this with NIFTY Range probabilities should help you improve your ability to make short term forecasts of market direction.