When I started trading, esp. day trading, a whole lot of people told me, don't do it, it's the most risky form of trading. Then when I would ask them why is it more risky than say positional trading, they would not have convincing answers. That was a good starting point for me to build my conviction around the possibility of success in intraday time-frame.

Likewise, when I started studying technical analysis, I was always surprised by the way traders at large perceive it, to be a predictive tool. If there is a crossover buy or sell. But they never told me why should the price move further if there is a crossover. That uncertainty brought me to the fundamentals, i.e. time, price and probability.

So in my search for people who view the market price action in these fundamental ways, I chanced up on George Angell. You can search more about him and his books, but here I am going to post a selection of videos which he did I guess in the 90's. Its a part of a larger series and I would recommend you watch most of them.

What to look for and be mindful of when watching the videos?

1. Focus on the larger contexts and broad methods, not really the specifics.

2. His definition of "Scalping" is different from how I refer to the word. Over here I use the Tasty Trade definition. Keep that in mind as he may come across as if he is against scalping.

3. His methods are pretty relevant to NIFTY and its nature/market structure, hence good to back-test the ideas if you are serious about using them. His recommendations about order execution may not be relevant as NIFTY is far more liquid today than what ES/S&P would have been then.

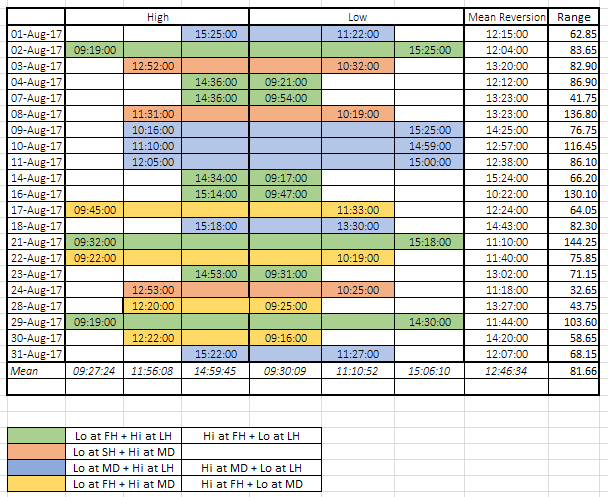

The first video explains the fundamentals of price and time. You will understand the causes of price movements. Why you get pullbacks? Why does a breakout happen? Understanding price equilibrium? Side note - He looks at 1 min. bars. Notice his emphasis on "Time" - How long does it take to get from point A to B, something most people overlook.